Property Value Assessment Sticker Shock?

If you’re a homeowner in the Dallas area, you likely experienced a bit of sticker shock upon opening your property value assessment recently.

What this means for your property tax bill is more nuanced, though.

“Considering for many of us our home is our largest investment, an increase in market value can be considered a blessing. However, many people equate an increase in market value to mean an equal increase in property taxes which is not always the case,” said Alvin Lankford, president of the Texas Association of Appraisal Districts. “The increase in what a person owes in property taxes is unlikely to be proportional to the increase in home values.”

Local municipalities have the power to set the tax rates that determine the amount of taxes paid by homeowners and businesses, so your property tax rate can stay the same or even decrease, but your property tax bill can still go up because the value of your home and the land it’s on continues to increase.

Data from real estate data curator ATTOM shows the effective average property tax rate in Dallas actually decreased by 12.2% from 2020 to 2021 while the national average effective property tax rate rose 1.8%.

How does this happen? Rick Sharga, executive vice president of market intelligence at ATTOM, said it suggests the housing market is so hot that home values are increasing faster than taxing entities can assess.

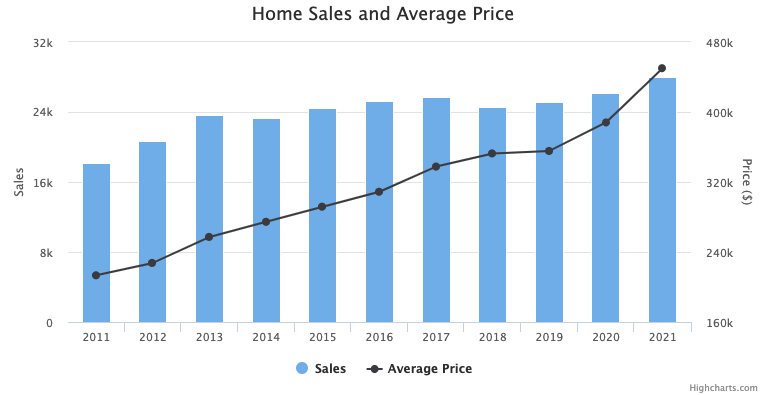

“It’s hardly a surprise that property taxes increased in 2021, a year when home prices across the country rose by 16%,” Sharga said. “In fact, the real surprise is that the tax increases weren’t higher, which suggests that tax assessments are lagging behind rising property values, and will likely continue to go up in 2022.”

Specifically, in Dallas County, the average estimated value was $442,492 with an average tax bill of $6,033, and an effective tax rate of 1.36%.

It could be worse, though, according to the Texas Taxpayers and Research Association.

The group said property tax reforms the legislature passed in 2019 are blunting some of the impact on tax bills.

Those measures include HB3, which limited public school tax rate increase to 2.5% after which point, an increase would need to get voter approval. HB2 set a cap on increases of 3.5% before voter approval is required.

Property tax relief is likely to come up in the next legislative session as well.

Read more from ATTOM here, and our sister publication D Magazine here.