Report: 19.7% of Dallas Area Homebuyers Reneged on Deals in August

The U.S. housing market saw an influx of canceled home sales this summer, particularly in Sun Belt markets, including Dallas-Fort Worth. The area previously saw a rush of homebuyers earlier in the pandemic.

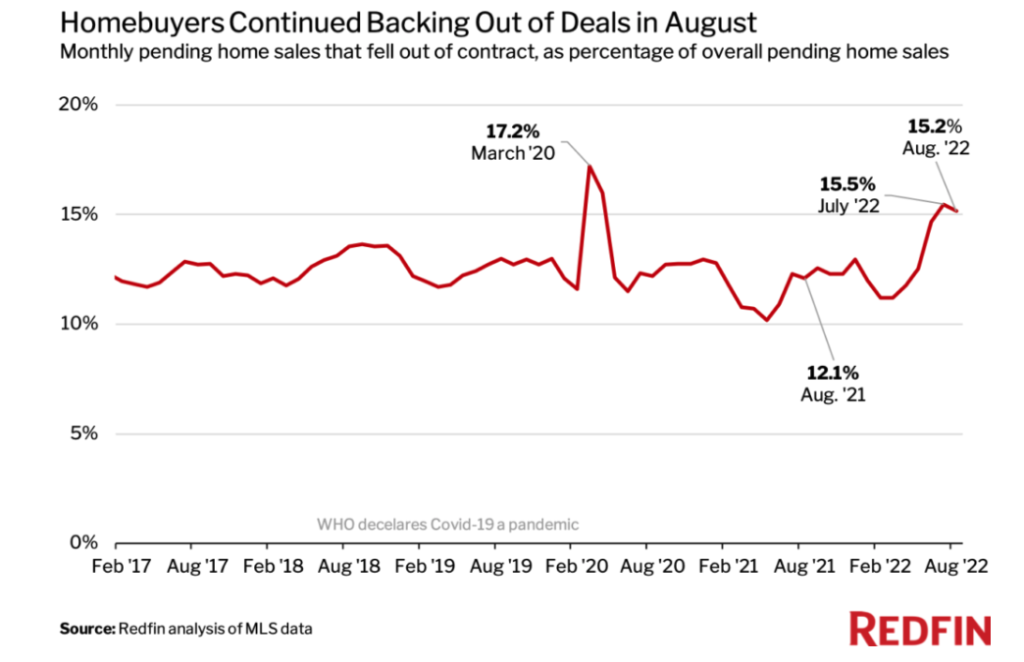

A report from Redfin shows 19.7% of pending sales in the Dallas area fell through in August, according to Redfin. Nationwide, roughly 64,000 home-purchase agreements fell through in August, equal to 15.2% of homes that went under contract that month.

“House hunters today are taking their time and exploring their options, whereas six months ago, they had to act quickly and pull out every stop to compete because homes were selling almost immediately,” said Tzahi Arbeli, a Redfin real estate agent in Las Vegas. “Homebuyers now will agree to buy a house and be doing the inspection, and then back out because they found another home they love more.”

The percentage has hovered around 15% for the past three months—the highest level on record with the exception of March and April 2020 when the onset of the COVID-19 pandemic brought the housing market to a near standstill. Before the pandemic, around 12% of home purchase agreements nationally fell through each month.

Buyers were most likely to back out in Jacksonville, Florida, Las Vegas, and Atlanta, and least likely in places like San Francisco and New York that saw people move out during the pandemic.

A slowing housing market is allowing buyers the power to renege on deals because it often means they don’t need to waive certain contract contingencies in order to compete like they did during last year’s homebuying frenzy.

“Including inspection, financing and appraisal contingencies in a contract means a buyer can cancel their purchase if there’s an issue with the home, they can’t get a mortgage or the appraisal is different from the agreed-upon amount,” according to the report. “Some buyers may also be backing out of deals because they’re waiting to see if home prices fall.”

Surging mortgage rates may also be a factor. The average 30-year-fixed mortgage rate hit 6.29% last week — the highest since 2008 — sending the typical homebuyer’s monthly mortgage payment up 45% from a year ago. “Some homebuyers are finding that by the time they go under contract and lock in their mortgage rates, rates could be much higher than they were when they toured the home and/or got pre-approved. That can kill the deal because the buyer is no longer financially comfortable with the purchase,” said Sam Chute, a Redfin real estate agent who works with sellers in Miami. “I advise sellers to price their homes competitively based on the current market because deals are falling through and buyers are no longer willing to pay pie-in-the-sky prices.”

For more information, read the Redfin report here.