Low Housing Inventory Creates Building Increase

The Dallas-Fort Worth region came in second in the nation when it came to single-family construction permits, a February report from the National Association of Home Builders showed.

And that boom, researchers from the Texas Real Estate Research Center at Texas A&M University said, is likely driven by a significantly low inventory of existing homes on the market.

“Demographic trends, such as aging millennials and migration from out of state, will help drive Texas housing demand in 2021,” said Dr. Luis Torres, research economist for the Texas Real Estate Research Center at Texas A&M University.

Nationally, existing-home sales rose 1.3 percent across the country relative to November. According to the National Association of Realtors (NAR), the annual growth rate was 5.6 percent. First-time buyers accounted for 31 percent of December sales, unchanged from the same time in 2019, but down from 32 percent in November 2020.

Statewide, months of inventory dropped to 1.8 months in December, and new listings added during 2020 declined more than six percent, the research center said in a press release.

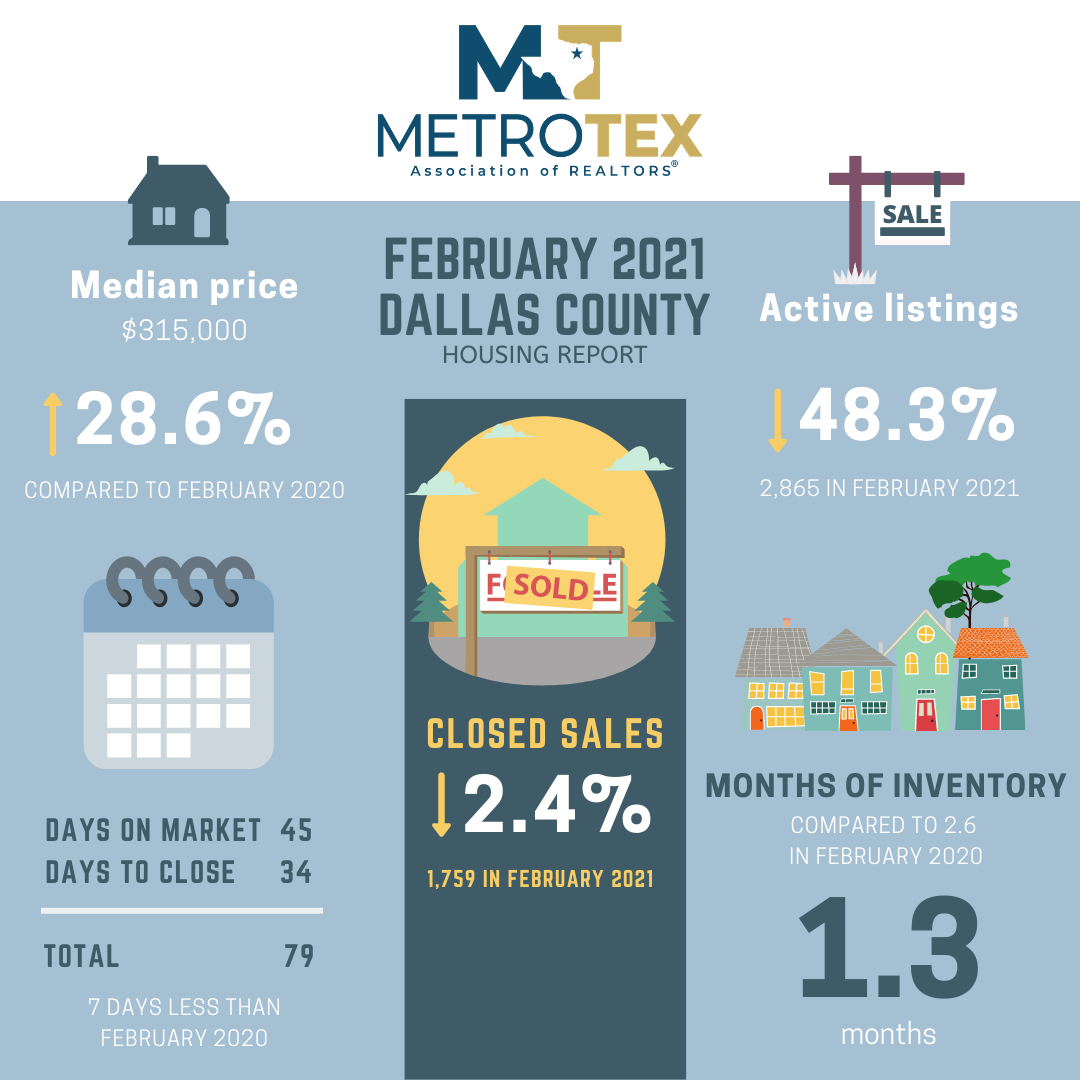

According to February figures from MetroTex Association of Realtors, average months of inventory for Dallas hits at a little more than a month, compared to last year when there was about 2.6 months of inventory.

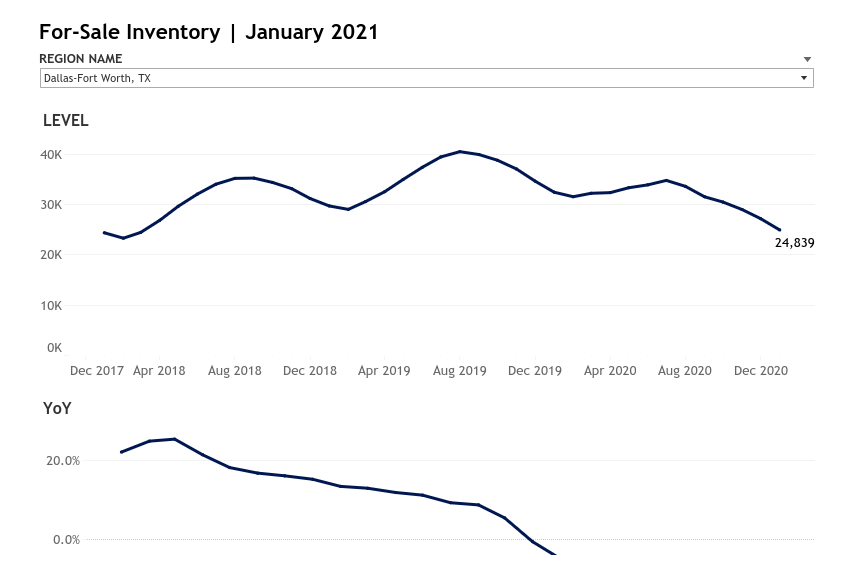

Last month, Zillow reported that year-over-year, inventory in the Dallas-Fort Worth area fell by more than 25%.

“Even so, low inventory on its own doesn’t necessarily mean the flow of new listings is drying up,” said Zillow senior economist Jeff Tucker. “Roughly as many new listings hit the market in the latter half of 2020 as in the second half of 2019. But the much faster speed of sales means buyers must move quickly to make an offer when they see a home they like, and the lack of alternatives visible at any point in time helps to drive the urgency and chance of multiple offers for each listed home.”

The disparity has resulted in an uptick in home construction, where single-family construction permits are expected to rise about 15% this year, Torres said.

“Homebuilders are trying to satisfy demand in the lower price cohorts by building homes in the suburbs or outer city borders where land costs are lower,” he said. “This trend was prevalent before the pandemic but has become even more widely adopted over the past year.”

According to the NAHB report, Dallas-Fort Worth saw 43,884 permits last year, second only behind the Houston area with 48,208.

The increase is also remarkable given the noted frustrations with the permitting process in Dallas.

“The region as a whole issued 16 percent more permits in 2020 than it did in 2019, but the city of Dallas issued 36 percent fewer permits over the same period: 1,050 compared to 1,637,” wrote D Magazine‘s Matt Goodman in January.

In September, D CEO‘s Bianca Montes reported that the city had a backlog of 445 or so residential permits, and builders were experiencing a permitting process that could take upwards of two months.